A few updates to the list of big recent discovery holes and "hot stocks"

Hopefully as this list develops the charts show the all too familiar rise and fall risk.

If we see an improved market in the next couple of years some of these stocks will likely feature and some of the fallers will build back on their initial discovery holes.

Some recent discoveries are in tightly share structures with good insider ownership.

Others will likely prove to have been the one hit wonders.

Review management, insiders and financing !

Sabtu, 31 Agustus 2013

Africa Down Under 2013

A number of Australian companies are exploring in Africa, there were some spectacular stock performances in the junior stock run through 2010-11.

This conference may update on progress. See also the "Regional Exploration - West Africa"

Selasa, 27 Agustus 2013

Martin Luther King - I Have a Dream

On August 28th, 1963, at the March on Washington for Jobs and Freedom, Martin Luther King stepped to the podium in front of the Lincoln Memorial. Around 10 minutes into his speech, King sounded as though he were wrapping up when Mahalia Jackson, the gospel singer and King's friend, shouted: "Tell them about the dream Martin". He ignored her at first. Then she shouted again. He put the text to the left of the lectern, grabbed the podium and, after a pause more pregnant than most, started to riff.

King's adviser Clarence Jones turned to the person next to him and said: "Those people don't know it, but they're about to go to church."

It's 50 years since Martin Luther King gave the speech that stands as one of the nation's favourite addresses delivered by one of its most beloved figures. But "I have a dream" wasn't in the text of the speech and its mainstream popularity only grew after King was assassinated.

Rabu, 14 Agustus 2013

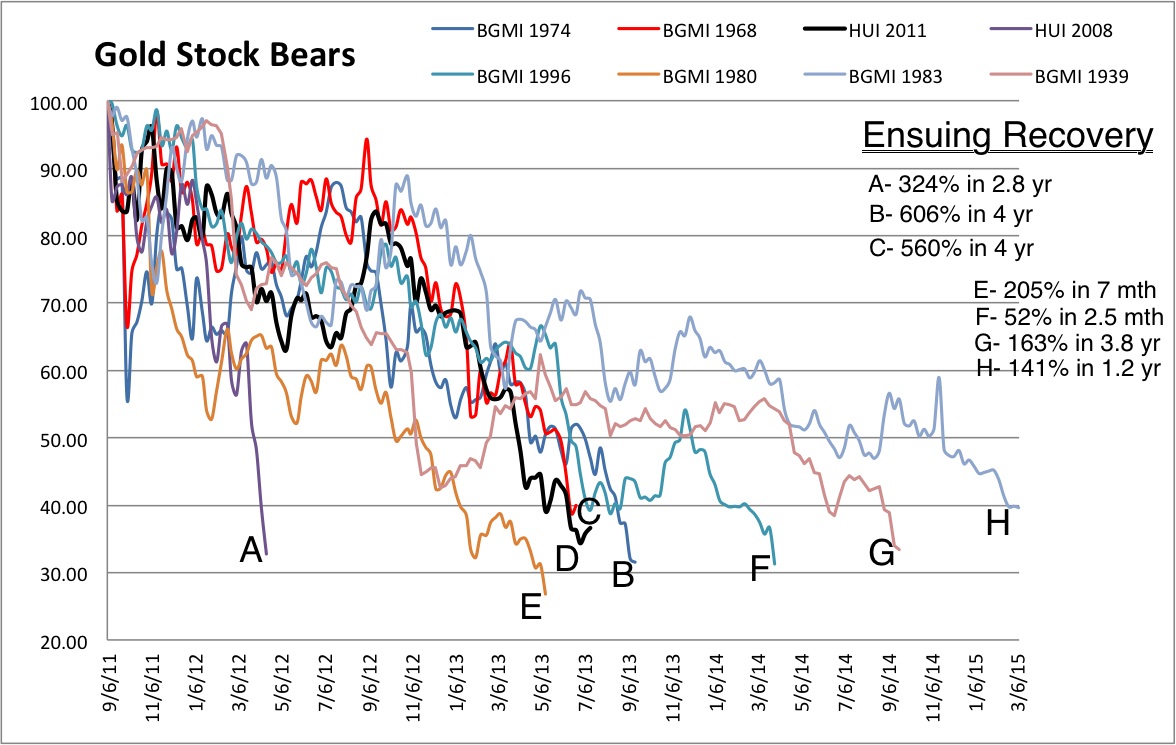

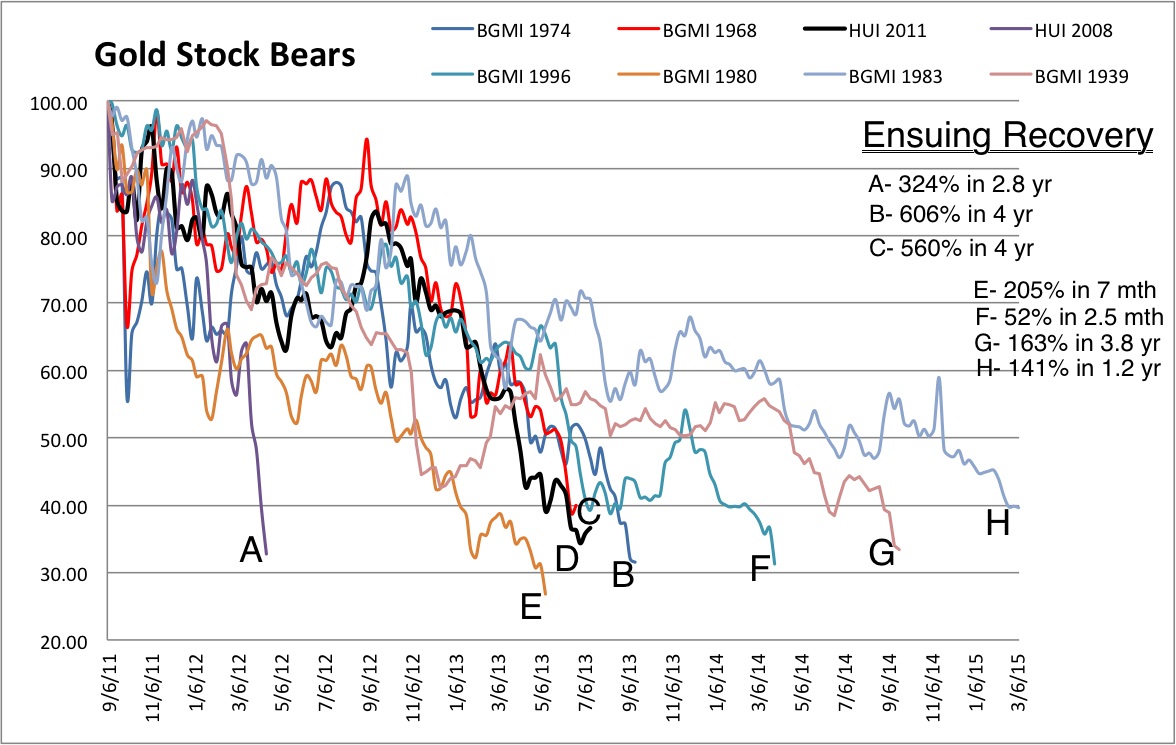

Bulls on Gold and Miners

Quite a number identifying a bottom in gold and the miners.

After some of the better mining stocks are up well over 50% ! Looking for pullbacks ....? ...................more.........

Many stocks up over 50%

Mike Swanson in 3 recent articles thinks this may be the start of a two year run into a bubble, sees a turn away from US stocks to Europe and commodities.

Jordan Roy-Byrne puts together a good overview

Clive Maund sees the same

After some of the better mining stocks are up well over 50% ! Looking for pullbacks ....? ...................more.........

Many stocks up over 50%

Mike Swanson in 3 recent articles thinks this may be the start of a two year run into a bubble, sees a turn away from US stocks to Europe and commodities.

Jordan Roy-Byrne puts together a good overview

Clive Maund sees the same

Selasa, 23 Juli 2013

Charts on Value in Gold Miners - Commercials - GOFO and Comex Stocks

Some interesting charts

Gold Miners offering value?

Commercial Traders Historically low short positions

GOFO extremes

Dramatically Changing "cover" ratios on the Comex

Comex Inventories

Some Food for thought here on what may be happening in the gold market

But beware.........

Bullion Vault doubt the Comex shortage issues

But Jim Sinclair suggests the rate of change is important

Gold Miners offering value?

Commercial Traders Historically low short positions

GOFO extremes

Dramatically Changing "cover" ratios on the Comex

Comex Inventories

Some Food for thought here on what may be happening in the gold market

But beware.........

Bullion Vault doubt the Comex shortage issues

But Jim Sinclair suggests the rate of change is important

Mike shedlock is positive on gold and the miners but sceptical of backwardation alarmismthe bottom ingold is not based on a Comex default as there will be no default. Secondly, what makes anyone think the Comex will wait to go to zero ounces in order to change delivery conditions? What counts is not absolute level, but rate of decline. Only someone without any real experience as a member of the exchanges would come up with the soft opinion you quote.

Jumat, 19 Juli 2013

Major Gold Producers and Developers - Roger Bade at Whitman Howard

These Reports are somewhat dated, from November 2012 and February 2013 but now seem rather prescient in their focus on economics at lower gold prices.

Indeed Bade seems fairly bearish on gold and the miners

A good appendix at the end trending return on shareholders' funds.

The Major Gold Developers

Of course a turn and upward trend in gold prices may see leverage come back to marginal stocks

MORE DETAIL.....

Gold Producers reviewed

Indeed Bade seems fairly bearish on gold and the miners

The Major Gold Producers and a review of the article

We are on record as arguing that this is a sector steeped in mediocrity. The sector has focussed on production and per ounce valuations for too long and will be forced to focus on shareholders’ returns as competition increases for the investor dollar.

A good appendix at the end trending return on shareholders' funds.

The Major Gold Developers

Of course a turn and upward trend in gold prices may see leverage come back to marginal stocks

MORE DETAIL.....

Gold Producers reviewed

| African Barrick Gold |

| Agnico Eagle |

| Alacer Gold |

| Alamos Gold |

| Allied Nevada Gold |

| AngloGold Ashanti |

| Apex Minerals |

| Argonaut Gold |

| Atna Resources |

| Aura Minerals |

| AuRico Gold |

| Aurizon Mines |

| Avocet Mining |

| B2 Gold |

| Banro Corp |

| Barrick Gold |

| Besra Gold |

| Brigus Gold |

| Buenaventura |

| Centamin Egypt |

| Centerra Gold |

| CGA Mining |

| China Gold International |

| Coeur D'Alene Mines |

| Crocodile Gold |

| DRD Gold |

| Dundee Precious Metals |

| Dynacor Gold Mines |

| Eldorado Gold |

| Endeavour Mining |

| Evolution Mining |

| Gold Fields |

| Gold One |

| Gold Resource Corp |

| Goldcorp. |

| Golden Star Resources |

| Gryphon Gold |

| Harmony Gold Mining |

| High River Gold Mines |

| Highland Gold |

| IAMGOLD |

| Jaguar Mining |

| Kingsgate Consolidated |

| Kingsrose Mining |

| Kinross |

| Lake Shore Gold |

| Luna Gold |

| Mandalay Resources |

| McEwen Mining |

| Medusa Mining |

| Nevsun Resources |

| New Dawn Mining |

| New Gold Inc. |

| Newcrest Mining |

| Newmont Mining Corp. |

| Nord Gold |

| Northern Star Resources |

| Oceana Gold |

| Orvana Minerals |

| Osisko Mines |

| Pan African Resources |

| Perseus Mining |

| Petropavlovsk |

| Polymetal Intl |

| Polyus Gold |

| Primero Mining |

| Ramellius Resources |

| Randgold Resources |

| Red 5 Limited |

| Regis Resources |

| Resolute Mining |

| Richmont Mines |

| Rio Alto Mining |

| St Andrew Goldfields |

| St Barbara |

| San Gold Corp |

| Saracen Minerals |

| SEMAFO |

| Signature Metals |

| Silver Lake Resources |

| Tanami Gold |

| Teranga Gold Corp |

| Timmins Gold |

| Troy Resources |

| Unity Mining |

| Veris Gold |

| Yamana Gold |

| As a result of our analysis, we would focus on Nevsun Resources (NSU-TSX), Dynacor |

| Gold (DNG-TSX), Gold Resource Corp |

| (MND-TSX) and would pay close attention to updates from Argonaut Gold (AR-TSX), |

| Northern Star Resources (NST-ASX), Rio Alto Mining (RIO-TSX/BVL), Teranga Gold |

| (TGZ-TSX/ASX), Timmins Gold (TMM-TSX/TGD-NYSE) and Veris Gold (VG-TSX). |

Developers Reviewed

| Ampella Mining (AMX-ASX) | Lydian International (LYD-TSX) |

| Azimuth Resources (AZH-ASX) | Midway Gold (MDW-TSX-V) |

| Atacama Pacific (ATM-TSX-V) | Millennium Minerals (MOY-ASX) |

| Azumah Res. (AIM-ASX/AZR-TSX) | Noble Mineral Res. (NMG-ASX) |

| Batero Gold (BAT-TSX-V) | Orezone Gold (ORE-TSX) |

| Beadell Resources (BDR-ASX) | Oromin Exploration (OLE-TSX) |

| Brazilian Gold (BGC-TSX-V) | Papillon Resources (PIR-ASX) |

| Canaco Resources (CAN-TSX-V) | Paramount Gold (PZG-TSX) |

| Carpathian Gold (CPN-TSX) | PMI Gold (PMV-ASX/PVM-TSX) |

| Chesser Resources (CHZ-ASX) | Premier Gold Mines (PG-TSX) |

| Colossus Minerals (CSI-TSX) | Probe Mines (PRB-TSX) |

| Continental Gold (CNL-TSX) | Rainey River Resources (RVS-TSX) |

| Crusader Resources (CAS-ASX) | Riverstone Resources (RVS-TSX) |

| Dalradian Resources (DNA-TSX) | Robex Resources (RBX-TSX) |

| Detour Gold Corp (DGC-TSX) | Robust Resources (ROL-ASX) |

| East Asia Minerals (EAS-TSX-V) | Romarco Minerals (R-TSX) |

| Eco Oro Minerals (EOM-TSX) | Roxgold (ROG-TSX-V) |

| Exeter Res. (XRC-TSX/XRA-NYSE) | Sabina Gold & Silver (SBB-TSX) |

| Gabriel Resources (GBU-TSX) | Sihayo Gold (SIH-ASX) |

| Golden Predator (GPD-TSX) | Sulliden Gold (SUE-TSX) |

| Gold Road Resources (GOR-ASX) | Sunward Resources (SWD-TSX) |

| Golden Rim Resources (GM-ASX) | Tanzanian Royalty (TNX-TSX-NYSE) |

| Glory Resources (GLY-ASX) | Torrex Gold Resources (TXG-TSX) |

| Gt. Basin Gold (CBG-TSX)/NYSE/JSE) | Victoria Gold (VUT-TSX-V) |

| Guyana Goldfields (GUY-TSX) | Vista Gold (VGZ-TSX/NYSE) |

| Intl. Tower Hill (ITH-TSX/THM-NYSE) | Volta Resources (VTR-TSX) |

| Keegan Resources (KGN-TSX/NYSE) |

| In terms of the companies reviewed in this document, we believe that Brazilian Gold |

| (BGC-TSX-V), Crusader Resources (CAS-ASX), East Asian Minerals Corp (EAS-TSX-V), |

| Gold Road Resources (GOR-ASX), Millennium Minerals(MOY-ASX), and Robust |

| Resources (ROL-ASX) might offer some value. |

Sabtu, 13 Juli 2013

Outlook for Exploration - Minex Consulting

HT to IKN

A very comprehensive survey of trends in mineral exploration and discovery from Minex Consulting who also make available a large number of additional reports and some interesting sources / links

Emphasises the enormous increases in expenditures but limited paybacks in discovery and, again in the mining industry, cost increases at the exploration stage.......MORE

As John Kaiser has pointed out much of the efforts of the recent gold cycle have gone into re-evaluating the economics of marginal gold deposits as prices pushed them into profitability, only to find costs have risen aggressively making some of those deposits marginal once more. Genuine discovery of low cost quality deposits in an industry struggling with depletion and costs could still provide great rewards. As the Minex report, Kaiser and Rule have suggested techniques and tools to make discoveries under deeper cover may be key.

The Minex report shows Lead and Zinc with shortfalls of discoveries vs mining rates, with Gold "Tight". Perhaps some of the silver miners with large zinc/lead by-products may see additional interest.

A very comprehensive survey of trends in mineral exploration and discovery from Minex Consulting who also make available a large number of additional reports and some interesting sources / links

Emphasises the enormous increases in expenditures but limited paybacks in discovery and, again in the mining industry, cost increases at the exploration stage.......MORE

As John Kaiser has pointed out much of the efforts of the recent gold cycle have gone into re-evaluating the economics of marginal gold deposits as prices pushed them into profitability, only to find costs have risen aggressively making some of those deposits marginal once more. Genuine discovery of low cost quality deposits in an industry struggling with depletion and costs could still provide great rewards. As the Minex report, Kaiser and Rule have suggested techniques and tools to make discoveries under deeper cover may be key.

The Minex report shows Lead and Zinc with shortfalls of discoveries vs mining rates, with Gold "Tight". Perhaps some of the silver miners with large zinc/lead by-products may see additional interest.

Langganan:

Komentar (Atom)